Key Highlights

- Located in Upper Guinea between two world class operating mines

- 11 km2 Land Exploitation Permit

- Focused on becoming a gold producer

- Phase 1 total identified gold potential of 128,950 oz to be recovered from 6 blocks at 92% purity (NI 43-101 compliant)

- In-situ potential value of $180 mil @ $1400 oz of Au

- Production can commence with the installation of a 100 Yd3/hour capacity wash plant

- Local contractor in place

OVERVIEW

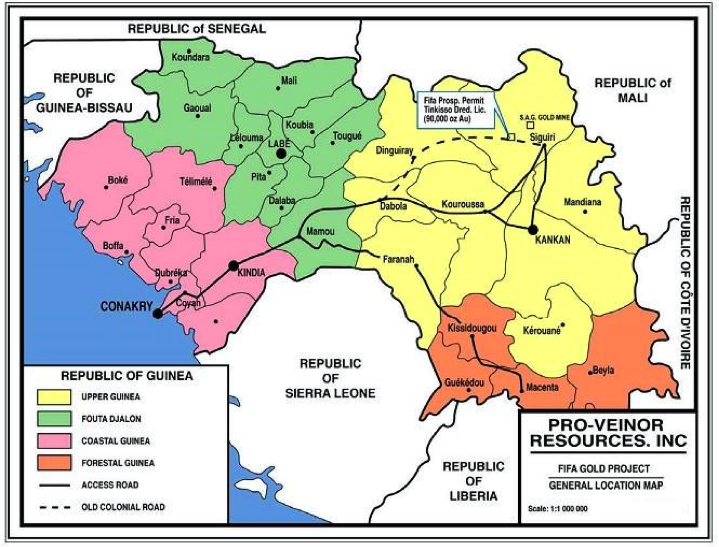

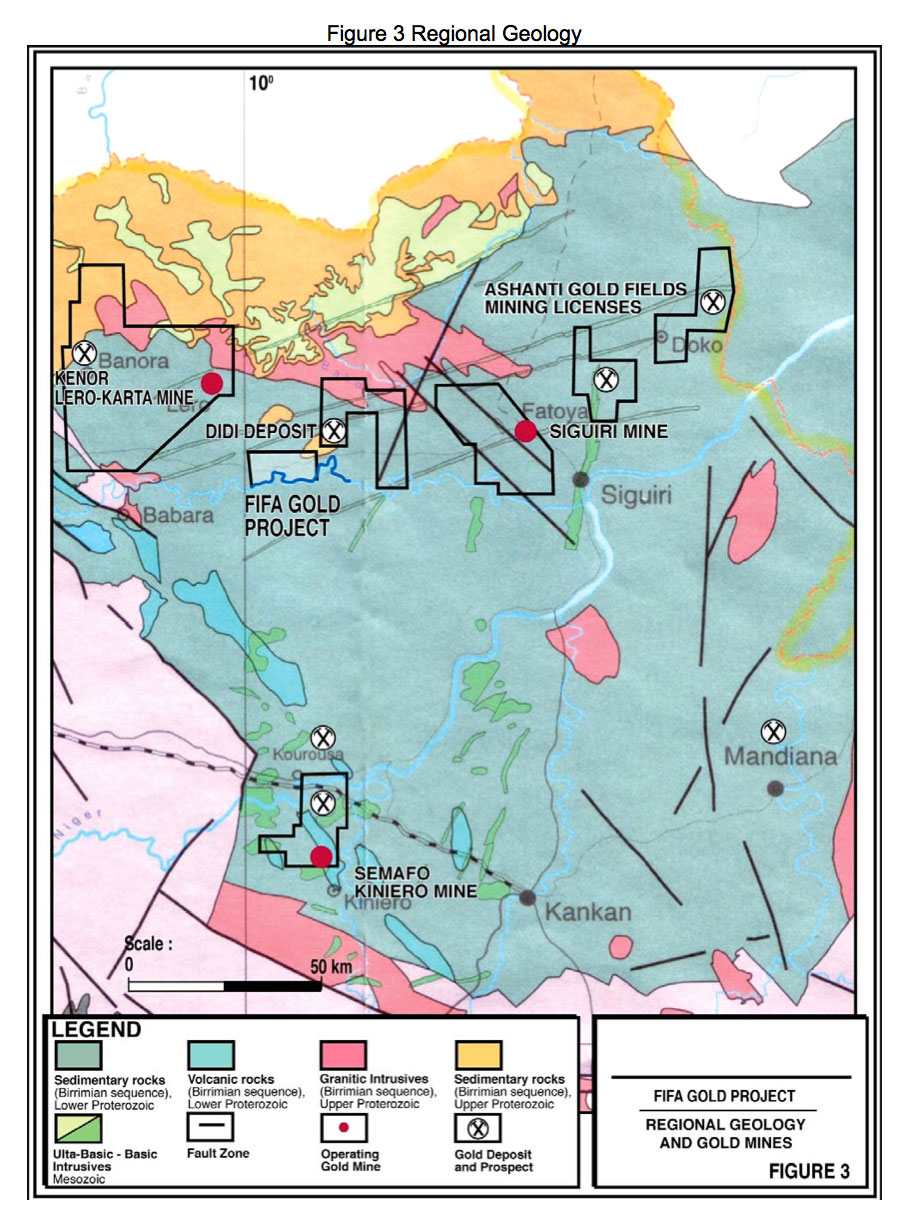

Hamilton Mining & Marketing S.A.R.L. (“Hamilton Mining”) is a private international mining company located in Upper Guinea which is focused on becoming an intermediate sized gold producer. The company currently holds the Fifa Land Exploitation Permit which is strategically located within a 70 km radius between two world class operating mines. Approximately 30 km west of the large Siguiri gold mine operation at Kintinian, owned and operated by AngloGold Ashanti, and 40 km from the Guinor mine located at Lero.

FIFA (LAND) EXPLORATION AND EXPLOITATION PERMIT

The Fifa Exploration Permit area is located about 80 km west of the town of Siguiri, accessible by Route Nationale #30. It is to the north of the prominent Tinkisso River which extends over 28 km and includes the gravel terraces on both sides, North and South, of the river. Hamilton Mining previously held a dredging exploration license for gold and associated minerals several years ago, but has since decided to focus on the alluvial and hard rock exploration.

The Fifa Exploration Permit area is located about 80 km west of the town of Siguiri, accessible by Route Nationale #30. It is to the north of the prominent Tinkisso River which extends over 28 km and includes the gravel terraces on both sides, North and South, of the river. Hamilton Mining previously held a dredging exploration license for gold and associated minerals several years ago, but has since decided to focus on the alluvial and hard rock exploration.

Over the past 10 years Hamilton Mining surveyed the 135 km2 Fifa permit area for an assessment of its potential for alluvial, eluvial-lateritic and primary gold deposits when it finally chose an area of 11 km2 around the village of Fifa as the most prospective of all areas for a retrocession and conversion from a Permis de Recherche Minière to a Permis d’Exploitation of the Fifa concession as mandated by the Guinean Ministry of Mines.

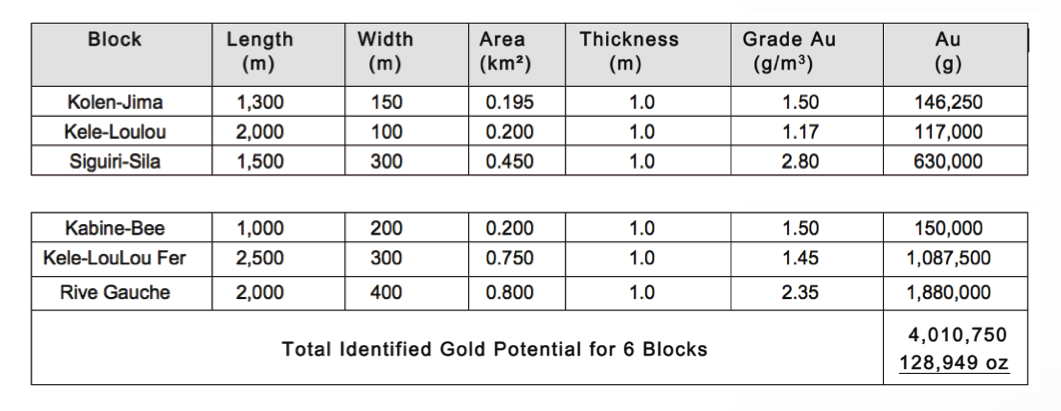

TOTAL IDENTIFIED GOLD POTENTIAL

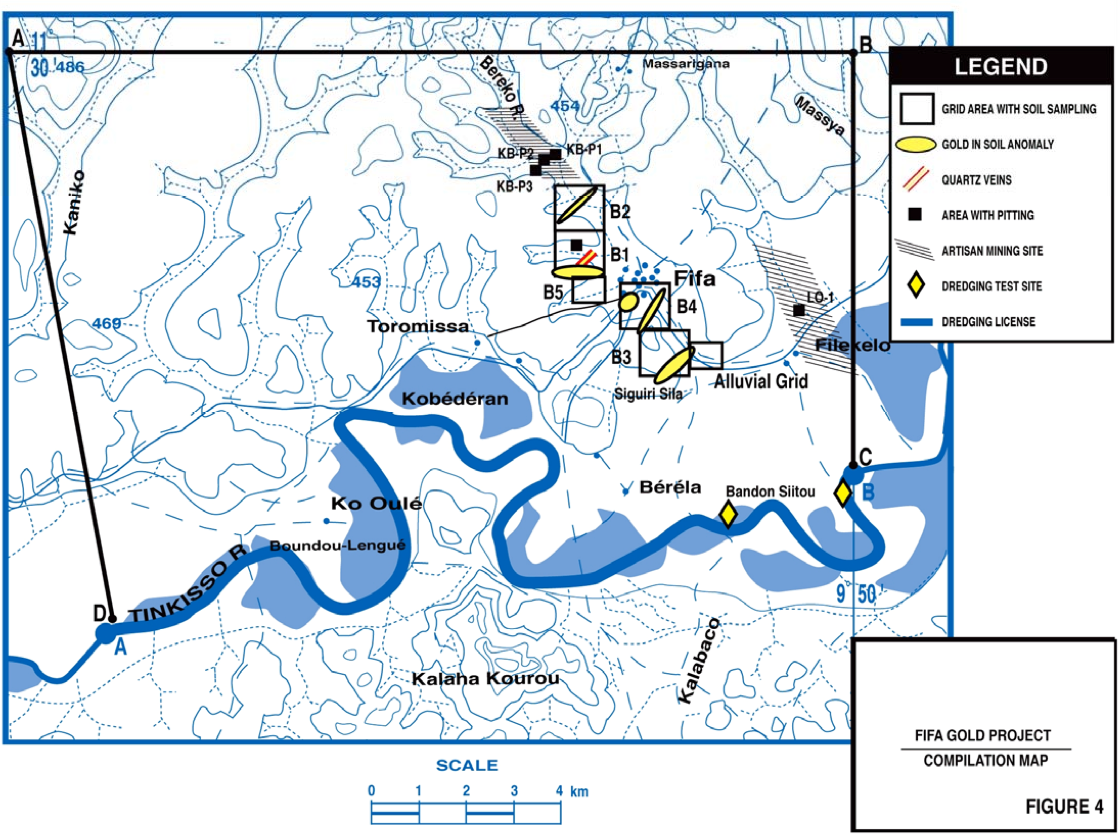

Field work consisting of mapping, pitting, soil sampling in laid out grids as well as trenching was carried out mainly West and South of the village of Fifa in the Eastern section of the permit area. Six prospective blocks were targeted for alluvial gold mining where previous local mining activity had taken place within the Fifa Permit: Kolen-Jima, Kele-Lolou, Kele-LouLou Fer, Rive Gauche, Siguiri-Sila and Kabine-Bee.

Hamilton Mining’s field crews excavated over 2000 prospecting pits mainly along the Bereko River, West of Fifa village. Gold grades of 0.2 to 1.97 g/m3 were recovered from the basal gravel of 0.27 to 1.16 m thickness. The overburden above the gravel ranged in thickness between 5.6 and 9.4 m. At Siguiri Sila, located South of the village and one of 6 alluvial prospects within the retrocession area, 14 pits were excavated in a 300 m2 grid with an average grade of 2.14 g Au/m3 and one of the pits showing a grade of 7.36 g Au/m3. Hamilton Mining’s original estimate was that these 6 areas hold the potential for 488 kg (approx. 15,700 oz) of recoverable gold. A later conservative estimate, based on newer and more detailed data and assuming that only 50% of the original ore has remained in-situ, inferred the potential for at least about 4,010 kg (approx. 128,950 oz) of gold to be recovered from the 6 blocks. At 92% purity and a price/oz of $1,200 that would represent a value of app. $142 million. The quoted number of ounces, however, appears to be very conservative in view of the estimate of B. Violette (based on 75% of original ore still remaining in place) in his NI 43-101 compliant report, where the author (B. Violette, 2004) quotes a potential for gold from alluvial (paleo-channel) gravels in the SE quadrant of the Fifa concession of approx. 269,600 oz Au.

Map of the Fifa Exploration Permit and the Tinkisso River Dredging Permits

The Fifa Exploration Permit reduced to New Permit Retrocession for Exploitation

FIFA Exploration Test Pitting Grid Line

Regional Geology

TEST MINING AND GOLD PRODUCTION FROM ALLUVIAL DEPOSITS

Heavy mining equipment such as trucks, excavators and front loaders were previously acquired for the purpose of mechanically testing the gold rich alluvial deposits in the 11 km2 license area

For test mining purposes Hamilton Mining stripped an area of 110 m x 20 m of overburden of quaternary saprolitic sediments reaching the 1 m thick gravel at a depth of 7 m

Stripping for the 110 m x 20 m Pit for Exploitation of a 1 m gold-bearing Alluvial Gravel Bed at 7 m depth

An Alaska 50 wash plant from Goldfields Engineering Corp. in Utah, with a 50 Yd³/hour capacity, was imported by Hamilton Mining to test for the best method of production. The average recovery of gold was 1.35 g/Yd³ or 1.77 g/m³. With an expected volume of 2,200 m³ from the 110 m x 20 m pit and a one-meter thick gravel layer the amount of gold expected from this first pit is about 3.9 kg of doré gold, or 125.2 oz. At an average purity of the doré of 92% the resulting .999 purity gold is around 115.2 oz. At a gold price of $1400 this represents a value of about $161,280. As it turned out, the 50 Yd³ capacity Alaska 50 plant was not sufficient and needed to be replaced with a higher capacity wash plant. Due to working capital constraints the project was placed on hold until such time a 100 Yd 3/hour plant could be acquired along with a crusher to be fitted at its front end to get the right size of fractions without clogging the system. This plant would help confirm what was previously demonstrated with the Alaska 50, that the gravel extracted from the first pit contained a large percentage of quartz, which could be a source for gold and also needs assaying.

The Company has plans to do bulk sampling to determine areas that can maintain a minimum average grade in order to run operations economically over the long term.

The company has a contractor in place which can commence mining operations once the first 100 Yd3/hour test plant is installed.

A 300 Yr3/hour capacity wash plant with a chemical final recovery circuit

Hamilton Mining will perform a NI 43-101 report on the alluvial deposits to further establish the costs, volume and grade of material to be extracted and processed.

EXPLORATION

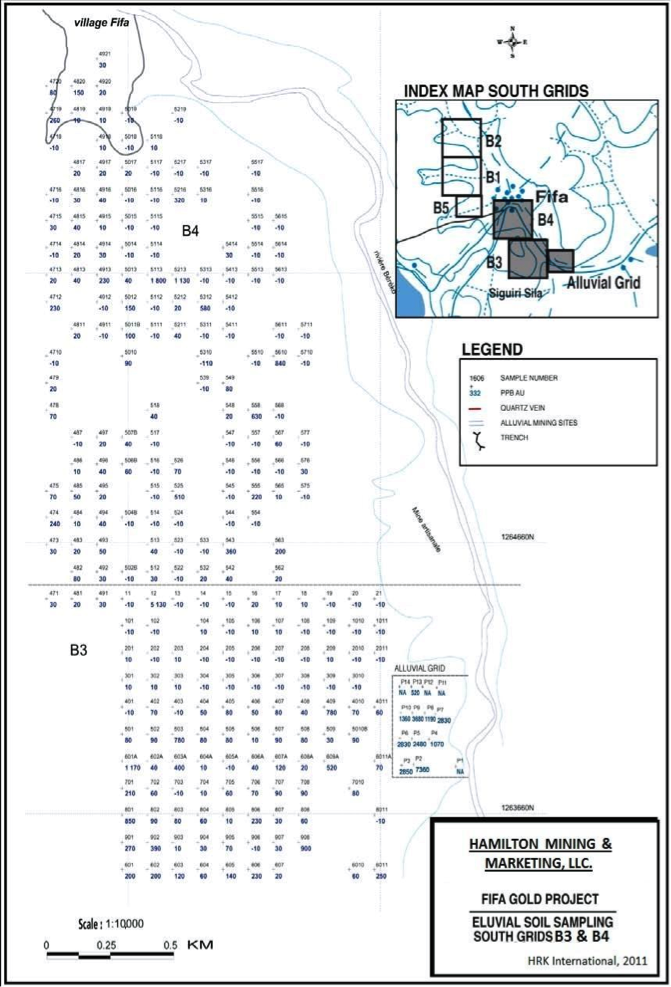

Eluvial Gold Deposits

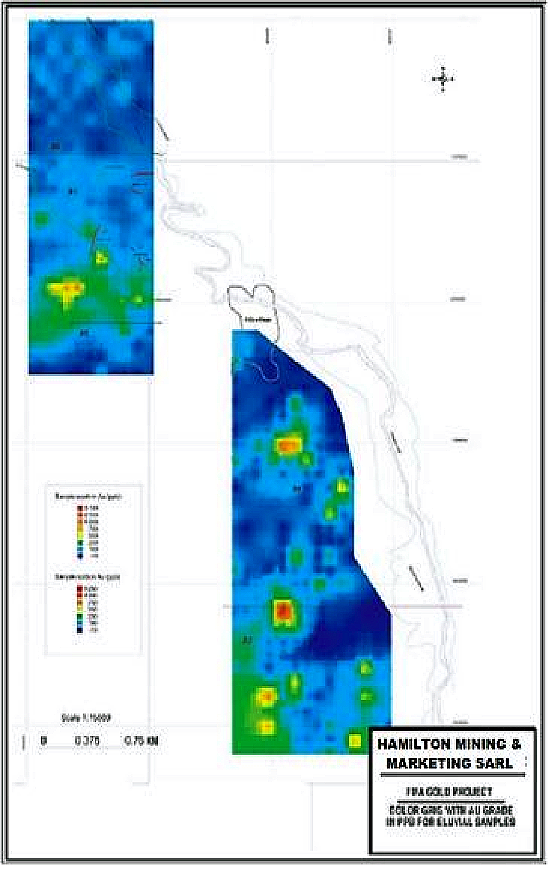

The existence of eluvial as well as hard-rock targets has been proven by earlier exploration. Soil sampling on 5 grids covering some 19.25 km² have revealed the presence of anomalous gold values in lateritic eluvial deposits forming large pediments on the property. Approximately 500 soil samples were taken at every 100 m². Where a gold-in-soil anomaly of over 1,000 ppbs (1,249 ppb or 1.25 g Au/t) was outlined at the South end of Grid B1, adjacent to the Kele-Lolou alluvial deposit, the sampling grid was reduced to 50 m² around the anomaly. Several gold-in-soil anomalies have been outlined on the various grids. The apparent orientation of these anomalies is along a NE to NNE trend. On Grid B1 a strong eluvial gold anomaly at least 1,000 m long and 200 m wide with a minimum of 100 ppb has been outlined.

Hard Rock Gold

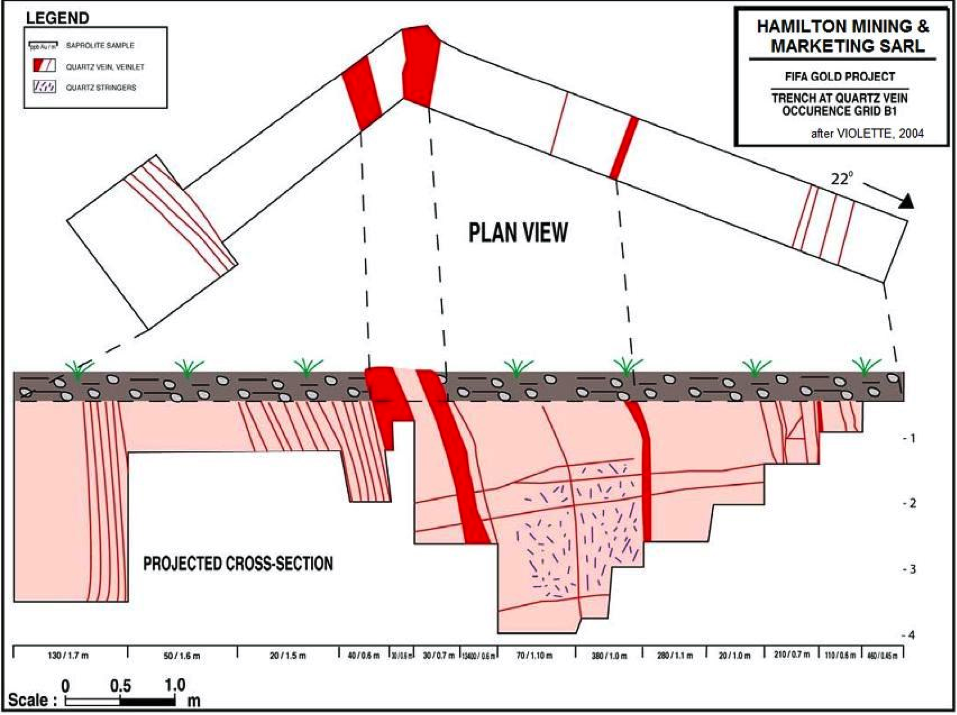

A great number of quartz veins and structures related to hydrothermal activity anomalous in gold have been found on the permit. A trench has been excavated to properly sample one of the veins located east of the village of Fifa. The trench has revealed that the vein is part of an extensive hydrothermal veining system similar to the one hosting some of the gold deposits at the SAG gold mine further East. Sampling in this trench returned anomalous gold concentrations in the altered wall rocks. The highest value obtained was a 13.4 g Au/t, over a 60 cm section of the trench. The overall average for the entire length of the trench (12.25 m) is 130 ppb Au, which is significantly anomalous and provides the evidence that a gold mineralizing hydrothermal system has affected the rocks of the permit area.

Fifa Exploration for hard-rock targets two outcrops of gold-bearing quartz veins (upper 2 pics) and altered quartz vein embedded in saprolitized birimian schists (lower pic) from Locations W and NW of the Village of Fifa

Additional Exploration

Reconnaissance prospecting and soil sampling around the village of Fifa has highlighted the overall great potential of the permit. That includes besides the vast potential for alluvial gold also the potential for eluvial- lateritic and primary hard-rock gold deposits. Hamilton Mining will conduct exploration work on the permit under NI 43-101 guidelines to determine the overall number of drill holes, diamond core and/or RC drilling needed estimate the potential for gold in both these deposit types separately or together. Looking at the four main gold mining locations around Fifa; SAG to the East, Lero to the NW, Dinguiraye to the West and Cassidy Gold to the South, which each have a similar geological situation and 100,000’s of ounces in gold reserves, Hamilton Mining is expecting to find significant gold potential.

Sketch of Plan View and Cross Section of Trench across Structure of multiple Quartz Veins in Zone B1

ACCESS, INFRASTRUCTURE, LOCAL RESOURCES AND CLIMATE

The Fifa Project can be accessed from Conakry by Highway N-1 to NE of Dabola, where the old Route Nationale N-30 turns off to the North to the town of Dinguiraye and further on to Matagania and to Fifa. This way the distance from the capital city Conakry is about 640 km. The track from Dinguiraye to the property at Fifa and further to the East towards the SAG Mine near Siguiri has been badly maintained for decades and is in a bad state of disrepair for about 100 km. The road access from the East is easier. The tarmac road is continuous from Conakry to Siguiri, the capital of the préfecture. From Conakry, the road is paved and in fair condition to Kankan (660 km). The road from Kankan to Siguiri (133 km) has been completely rebuilt and is paved. From Siguiri to the project area, the first 25 km of track to the SAG Siguiri Mine are well maintained by SAG. Branching to the West shortly before the mine, most of the remaining 63 km to the Fifa property along the Eastern segment of the N-30 are in poor condition but could be improved by simple grading. There also are three major creek crossings which need improvements for transport of containers or heavy equipment to Fifa which is estimated to cost app. $15,000 and can be done by a bulldozer. During the rainy season, access to the property could be difficult due to high water flooding in narrow stream valleys.

A town of over 100,000 inhabitants in Siguiri together with the SAG mining operation at Kintinian offers a wide range of services, including drilling and mining contractors, heavy equipment repair facilities and spare parts, an analytical laboratory operated by SGS and a broad range of logistical services, such as food and fuel. Abundant skilled and unskilled labor also can be found in the area. Siguiri has an airport, which occasionally is serviced by flights from and/ or to Conakry.

The Malenké ethnic group forms the majority of the population, which gains its living through agriculture, fishing and the breeding of goats, sheep and cattle. An important source of income is the artisanal gold production from mostly alluvial deposits.

The climate of Upper Guinea is qualified as dry tropical with two seasons. Between November and May, a hot (40°C) and dry season prevails and between June and October a wet season with precipitation in the range of 1,300 mm. During the rainy season, water rises in the stream and rivers, roads are cut off and often field work has to be suspended.

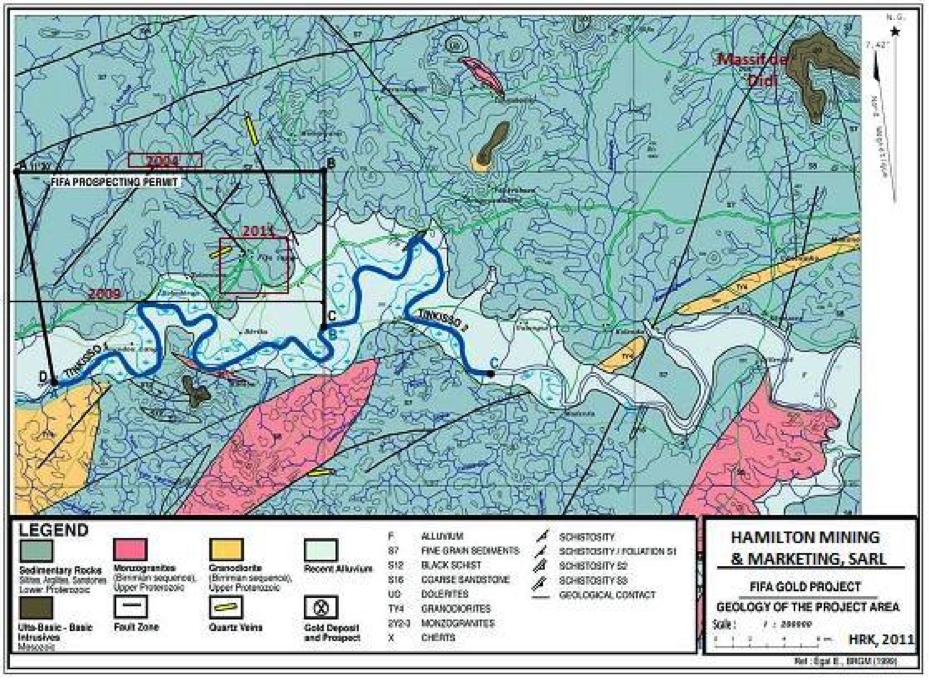

LOCAL GEOLOGY OF FIFA PROJECT AREA

According to the geological map of the Siguiri map sheet at a scale of 1:200,000 produced by the BRGM (ÉGAL et al, 1999) the Fifa gold project is underlain by finely stratified siltites, argillites and minor feldspathic sandstones typical of continental marine platform deposits and filling up most of the Siguiri Basin. The property is almost entirely covered with lateritic duricrust plateaus, pediments and recent alluvial deposits. Rocks in outcrops are mostly saprolitized. Rocks fragments of these formations are found in the rubbles and rock debris left from the artisanal mining activities in the alluvial flats of the property. Along the Bereko River most of these fragments are weathered phyllites.

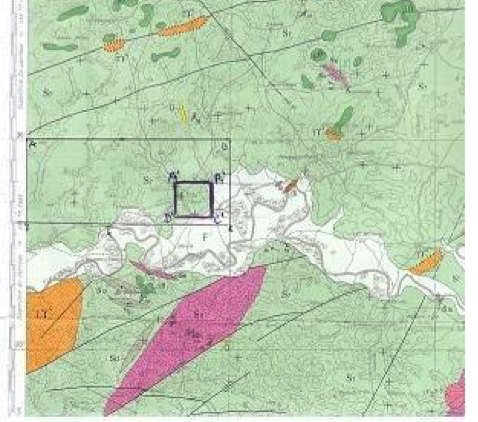

Map of local geology of the Fifa area with contours of the sizes of the Fifa Reconnaissance Permit and the Retrocession for a Permis d’Exploitation

Immediately to the South of the Fifa concession the pelitic sequences are cut by lenses and larger bodies of monzogranite and granodiorite of the type recognized throughout the Siguiri Basin. Altered and weathered cobbles of a fine to medium grain rock of basic composition (diabase) have been observed in the area of Grid B1.

There are only few locations available, where bedding can be clearly observed. S1 schistosity, the ductile deformation affecting the sedimentary sequences, was observed along a general NNE axis. E-W orientations also have been noted south of the property.

The linear appearance of some of the streams draining from the North towards the Tinkisso River in and around the property suggests that NNE to N-S and ENE to NNE structures have affected the rocks in the area of the property. The various orientations of quartz veins and some of the ridges observed on the property and elsewhere are concordant with these orientations. Evidence of hydrothermal activity is obvious at the Grid B1 gold occurrence in bleached saprolite. Several of the hills and plateaus around the village of Fifa are littered with quartz vein and silicified rock fragments. At least some of the gold recovered by the artisan mining activities from alluvial deposits on the permit most likely has its source in these structures.

50-Year High In Central Bank Gold Purchases

Strengths The best performing metal this week was palladium, up 2.04 percent as hedge funds increased their net-long position in the futures market to a five-week high. Gold traders and analysts are mostly bullish going into next week in the Bloomberg survey amid mixed signals over progress in the U.S.- [...]

Markets Bet That Gold Could Triple to $4,000

November 27, 2019, 10:32 AM PST Updated on November 27, 2019, 4:00 PM PST The gold options market saw $1.75 million in block trades betting the precious metal could almost triple in more than a year, surpassing the record. Around noon in New York Wednesday, 5,000 lots of a gold option giving the holder [...]

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

These pages include forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as Unity Goldmines, Inc. (UGM) or its management “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” or other words or phrases of similar import. Similarly, statements herein that describe Unity Goldmines, Inc.’s business strategy, outlook, objectives, plans, intentions or goals also are forward- looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.

This presentation is pro-forma, subject to change, and strictly for those that qualify as ACCREDITED or SOPHISTCATED INVESTOR (s) as defined under the Financial Services Authority and to whom it is directly addressed and delivered to from Unity Goldmines, Inc.This presentation is for discussion purposes only and is not an offer to buy or sell securities.